#MondaysMotivation – NEW 1003 Week!! – We are less than two months away from July 2019 when the new 1003 becomes optional. ARE YOU READY? Have you looked at it, and do you understand the new stuff on it, or the things that stick out that changed? Actually section 1 is completely new! And this week we will go through each section and highlight the changes, what’s new, and how it applies to your new process of taking an application.

Today I will break down section 1, and provide my synopsis and point out differences and note-able changes. The biggest change is mulitple people are NOT on 1 application even if married. Only 1 person is. Every person fills out an application and then on the application there is a place to list other borrowers applying for this loan. (however they need to fill out a separate 1003) Again the 1003 claims only 1 social security number and date of birth for “the borrower” on it. And lists the names and total number of borrowers for the loan.

The same flow as the current 1003, just a different look and feel. The second major area on page 1, section 1a is the current address section. Much like the current 1003, the rule of having 2 YEARS HISTORY for EVERYTHING is pointed out. (most commonly missed thing for 1003’s) I love the military declaration section, and it’s interesting they added the new section for the primary language preference. Biggest notable is the radio button options for No Primary Housing Expense, and or Rent or Own. And to the right is an area to identify how much. Check it out ↓

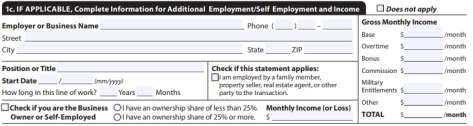

Page 2 starts off with income section, and is considered section 1b. The main thing I like is the fact there is a flow for listing the job and then the amount at that job on the same place on 1003. Must like the current address and amount of that housing expense, this lists the job/self employment and that amount they make. If self employed that box is at the bottom left instead of top right, and has a declaration section for ownership that is new. Then a separate place to indicate income from self employment income. Over the right “gross monthly” income is broken down for those employed only, such as base, OT, Bonus, Commission, or Military income and or other. Also note-able is the “statement” box dead smack in the middle of this area. If they are employed by some party involved in the transaction it must be identified.

The next section “if applicable” is for additional income. Meaning someone whom has two jobs for example. This is the section for that. ↓

Next up is the PREVIOUS employment section, again “if applicable” and current employment is less than 2 years. Note-able in this section is the fact on previous employment the client must provide previous monthly gross and identify if self employed. Known as section 1d.

In the last section on page two, and rounding off section 1 of the new 1003 is section 1e. This identifies all “other” income. And the way it’s portrayed is a great reminder for LO’s to see as it lists all the other income types to remind you to ask.

Proceeding that at the way bottom left there is a line on page 2 at the bottom that identifies which client’s 1003 work information you would be looking at. I can see this one of those lines that drives LO’s nuts and is constantly left blank. This is why each person has a separate 1003 now. So even if they are married, just as section says at the top, you are identifying if that application is a “joint” or individually. And if with other’s you list the total number and names of all other’s that would have a separate 1003 associated with the transaction. Here’s a snip of the bottom of page 2. Get to know it is my opinion. 🙂

As always – #GetOnPoint with your own craft and know the 1003 like the back of your hand.

#SellWell