How do you use a loan against a property to develop wealth? I say at least 4 ways…

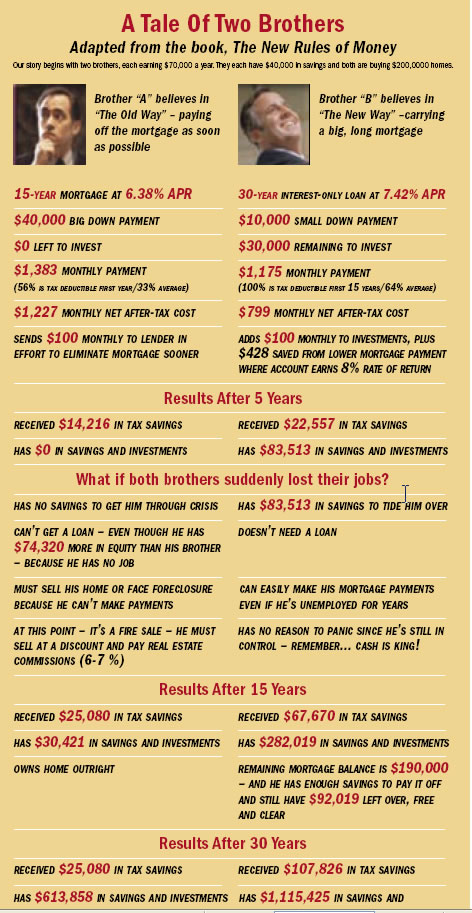

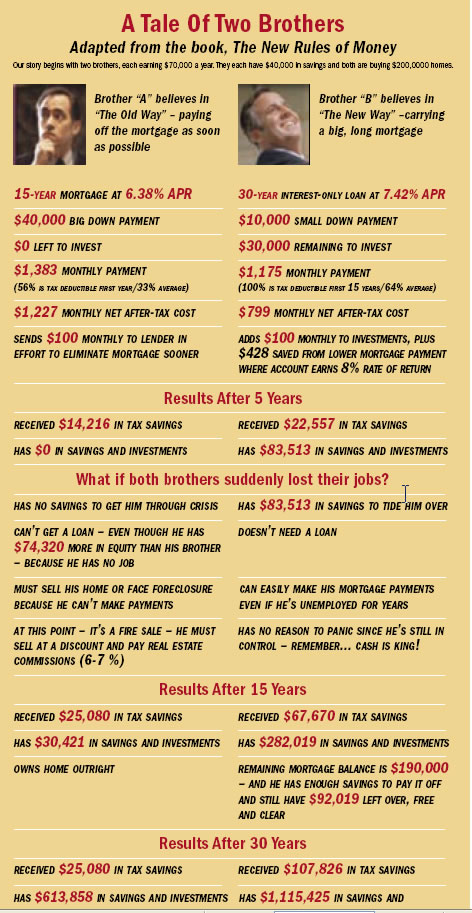

More and more people are in need of understanding how to leverage their efforts to build more wealth. There is a story out there of the “two brothers”, whom one gets a big fat 30 year fixed loan and the other gets a 15 year mortgage. Over time the one brother with a 15 year pays his house off, whereas, the other brother never does, he utilizes his money to make money.

First of all, those that think a short term is best, keep in mind that you are actually losing your purchasing power by tying up your DTI (debt to income) ratio with a larger payment. Where the lower the payment due to the longer term allows you to “afford” more stuff, be a car, boat or other homes.

Second, knowing some lending guidelines can help the average Joe investor. You see, when you get more than 4 financed properties in a portfolio your lending rules change. So, if you have 5 financed properties you can NOT do a cash out on any investment properties. (well you can, it’s called delayed financing and only available within the first 6 months you buy the house CASH) If your in that position, it’s my advice you get a LLC formed and start putting those homes in a business portfolio and freeing up your personal credit again.

Third, the average JOE American will actually have 4-7 mortgage’s in their life. Most people that get a 30 year mortgage as a purchase loan do NOT keep that loan for 30 years. One of the major advantages of having a mortgage is the tax deduction on mortgage interest, but most know that. The second is how to utilize the mortgages you do. Let me paint the picture. Mortgage loan number 1 is obviously to buy the home. Mortgage loan number 2 is typically within the first 5 years where someone refinances to “save money”. Mortgage loan number 3 is typically for debt consolidation as a cash out loan. Mortgage loan number 4 is to potentially eliminate private mortgage insurance and save money again. Mortgage number 5 or more, could be to recast or reset the mortgage to a new 30 year fixed just to have a small 60-75k mortgage for tax deduction purposes.

In conclusion on the story of the two brothers, the one that paid his house off and then started his major push to build wealth generated less portfolio net worth than the other brother. The one brother that didn’t take a big payment allocated his money to other investments along the way and created more wealth in life in other assets. From buying other houses to even investing more in retirement.

In conclusion on illustrating this, a mortgage is a wealth building tool and you just don’t call a mortgage loan officer to “lower your rate”, a mortgage should be custom tailored to help you BUILD wealth. And if some client is calling you today just asking for your rate and not willing to have a conversation with you or let you pull their credit, they are missing the boat. Show them the link to the tale of two brothers and have them call you back once they read it. GOOD loan officers should look at the full financial situation and goals of the individual to know what makes sense to help a client reach those goals. IF anything. And sometimes for those knowing they are moving in the next 1-3 years should actually do nothing. My Dad is a perfect example, he bought everything I ever sold from Cutco knifes to what ever widget I sold, but when I originated mortgages, especially interest only loans he was against them. Until one day my Sister was in need of money for her wedding. He came to me and I advised him to take the biggest home equity line he could, and he did, he turned the whole mortgage to an equity line. And he was the type that was ALWAYS against ARM’s (adjustable rate mortgage) and Interest Only loans. He took advantage of where the market was in the last 7 years or so and has paid the same amount on the mortgage for years. Due to him doing this, not only did he get the cash to pay for my Sisters wedding but he’s paid less in interest and owes less now on the home than if he had stayed where he was. He accelerated his principle payments through his own discipline. And recently just did his 5th loan, where he refinanced it all on to a fixed 30 year now just to have a small payment and interest to write off. Loan officers that actually present themselves this way to help custom tailor a mortgage to help a client reach life goals will not only get more referrals but will do more loans.

Sell Well – Juiceman

Tale of two Brothers